The Great Oakening Update of April 2022

The big update to Tradelands has been dubbed the “Great Oakening” due to the glitch that occurred during the update. As expected, the release was right around the time when the Tradelands team makes their big annual change. This year, the focus was on improvements to the economy, which gives us a lot to cover.

First thing to cover are the cosmetic impacts. The release of five new wood types (plum, green, lemon, blue, and red) means that all of the primary colors are available in game except orange. This is exciting and should lead to some interesting creativity among crafters and builders. On the other hand, be aware that we will not be covering the impact of The Great Oakening glitch, despite the title of this article. That’s because of the abundance of videos about it already online, plus the relatively nominal impact it has on the trading and economic side of the game. The developer has already indicated that he will not allow trading of glitched items, so any reporting we do on it is effectively providing bannable advice. That’s not the purpose of our group.

With that said, let’s go update by update and break it down.

New Premium Woods

There are five new premium woods on the market now. They are all purchasable with premium tokens, available for a limited duration, and there is no indication that they will ever be dropped from trees. This means they will not impact the JSI Index directly and will likely end up on the Guild Earnings Index if they are able to maintain sustainable trading volume.

The F&BP Company intends to fast track these materials into the stock market. Watch for updates over the next few weeks as there will be some changes to make room on one of the primary indexes. A couple of things we can already predict is an increase of Premium Tokens over the next few weeks. Also, based on the developers comments to-date we expect prices to follow similar trends as Heartwood rather than Blood Oak and Angelwood, which will limit profitability by following predictable patterns.

Changes to Ship Construction

Ship construction has a major overhaul. The most important change that impacts the market will be the removal of Pine and Spruce Decking as a requirement for high-level ships. The existence of decking kept Pine and Spruce in constant demand since they were the only two woods that had to be obtained from trees since they were not on the premium market. The decision to remove decking will likely cause a collapse in demand because of its scarcity and cheaper alternatives. We will be watching this closely to see if merchants start a fire sale on these two wood types or attempt to keep the price stable.

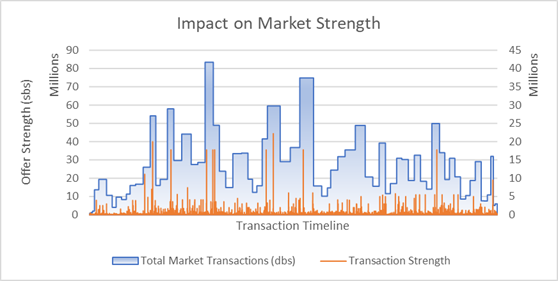

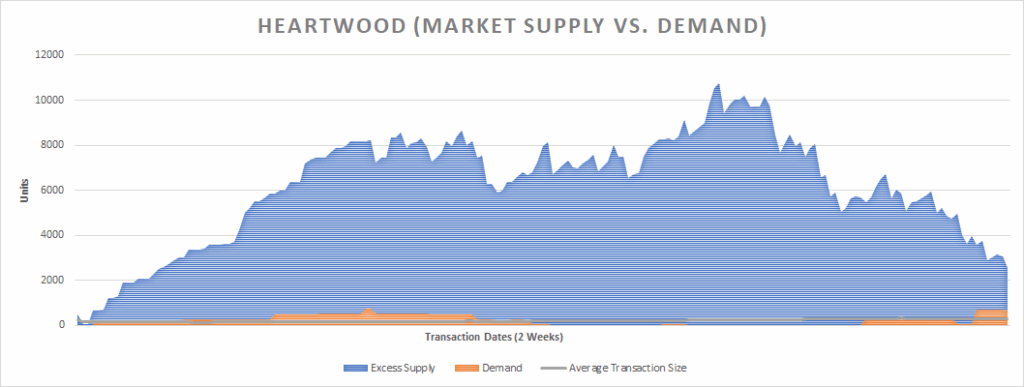

The other big change is that the secondary colors for wooden ships can be changed without re-building the whole ship. This is significant because re-building an end-game ship usually required thousands of one material type, meaning it was often viewed as out of reach for regular players and thus generated no demand. Look back at the Heartwood chart from earlier and notice the almost negligible “Average Transaction Size” that almost always stays below 1000 per transaction.

This change means players can make upgrades to their ships with stack of 100 to 200 materials instead of thousands. This is a great change if the goal is to create a steady and incremental demand. Popular wood materials are less likely to see temporary spikes this way, and it should help prevent some of the price manipulation we’ve seen from premium woods as well. Moreover, the fact that these cosmetic changes require Premium Tokens will once again ensure demand remains steady.

Lastly, the addition of four new ship types is likely to be the talk of the community. However, as far as the economy is concerned, their addition will add to the demand for wood but isn’t likely to impact any of our mercantile recommendations in any significant way. However, F&BP realizes that it may be time to release our recommendations for ship construction, which will explain why we do not recommend any of the new ships for trading. This is on our to-do list so expect some updates in the future.

Prometheus Returns

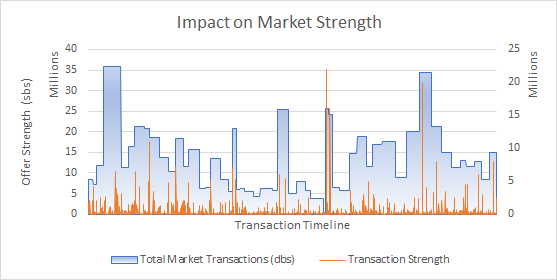

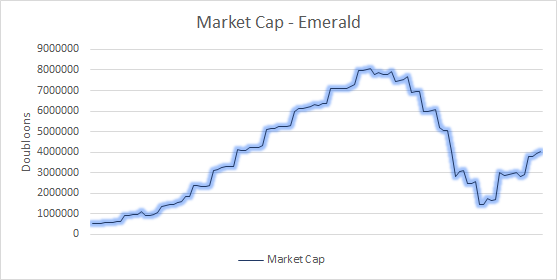

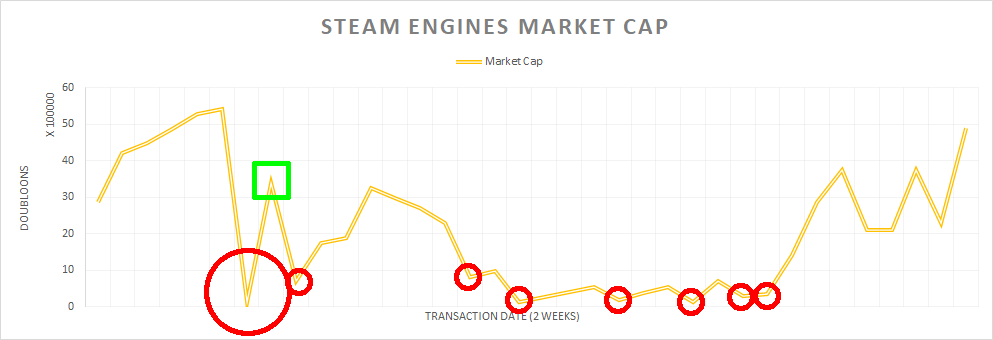

The Prometheus returning has an important impact on the EMG Index. When the ship was removed last year, we saw a dramatic (almost instant) decrease in demand for Steam Engines. In fact, we had to completely de-list Steam Engines earlier this year because the index effectively defaulted and could no longer pay back any returns.

Since the announcement of the return, there is already some emerging interest. We haven’t seen a return in demand yet, which is why the market cap is so volatile. If the developers focus on adding one or two additional steam ships that require Steam Engines, this is likely to rebound. Otherwise, we will continue to watch it and see if there is a recovery. Right now is seems to be hype among wealthy players, but nothing more.

Mining Update

This year’s update includes some changes to mining. The change log alludes to rocks having 3x health. However, this change isn’t as significant as it seems. What it essentially does is make the hit counts match those of trees, which are already at the 3x health level. On a more practical level, what it really does is remove the volatility of mining where the hit count can have up to 20% increase/decrease in overall output per pickaxe based on the random number generator.

| Type | Average Hits per Drop | Best Average | Worse Average |

|---|---|---|---|

| Wood Axe | 4.37 hits per drop | 4.22 hits per drop | 4.58 hits per drop |

| Pickaxe | 4.38 hits per drop | 4.14 hits per drop | 4.98 hits per drop |

In the old system, your hits were carried over from rock to rock as long as your were able to maintain a steady rhythm. This made mining paths very important. However, in the new system, assuming it is the same as trees, your hit count is based on the tree instead of overall hits over time. This should make output more consistent, but it also means min/max players can see a 10 – 15% decrease in efficiency as a result. This could have an impact in mining prices so we will be watching this one closely.

As a side note, there was an unannounced change that was reported by the community – Canoneer’s Key no longer drops gemstones. If true, this makes this location the worst mining choice of all islands. We already reported the marginal status of the Key in our last Mining Statistics update, and this will just make the situation worse for this remote location. However, this isn’t confirmed and we are sending miners to investigate the claim. As always, it will take time because, even if it’s obvious as we are performing it, we don’t like to report findings until they are deemed statistically relevant.

Fish Cargo Changes

Last but not least, the change log indicates that fish received a 10% boost in price. While a good move on paper, our initial trade runs seem to be reporting that the actual change was a 10% drop in prices for all other cargo. We are still confirming this, but if so it’s a very misleading way of reporting this change to the community. One of the fleet members is reporting that they may have actually reverted cargo prices to an earlier version of the post April 2021 price changes. If so, that means it’s probably a mix-up and nothing to be concerned about.

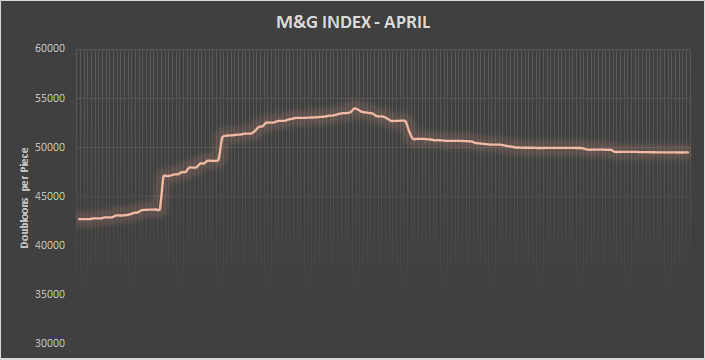

However, if this was intentional, it’s probably a positive move overall. We’ve been reporting inflation within Tradelands to be around 7% – 12% depending on activity, so reducing the inflow of doubloons by 10% should help stagnate prices. This is something that can be analyzed over the next month or two to determine if there is a correlation. However, due to how late in the month the release occurred, we are sticking with our previous estimated growth rate of 9.25% for April.

This is a cross-post from the Tradelands Nation News.