Tradelands – Watch Out for Wood

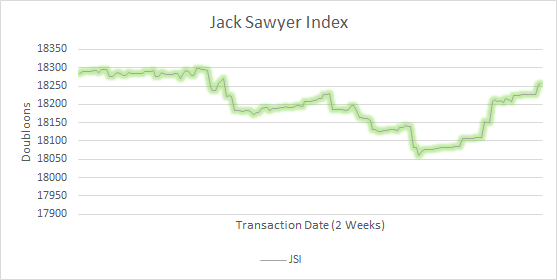

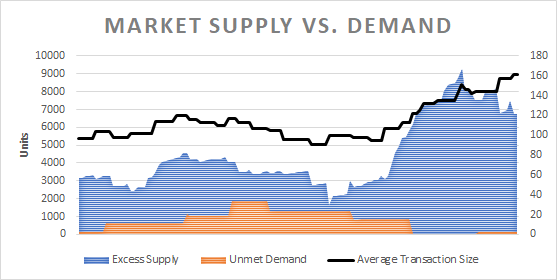

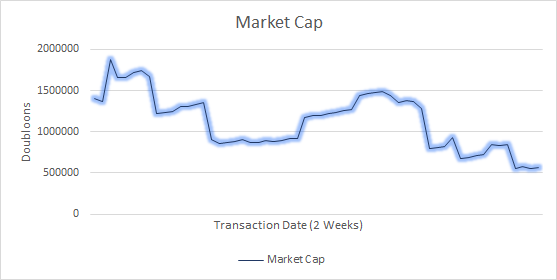

In our End of May analysis, we projected that wood prices will be one of the first to rebound. Today, we will dive deeper into the wood market and show what has happened over the past month, and why it looks like a strong market going forward.

Oak Sells

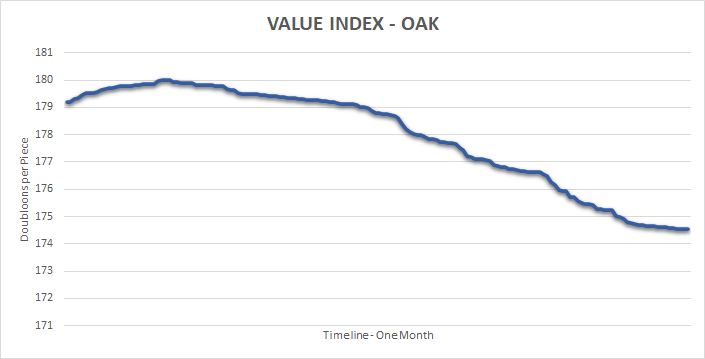

In general, May was bad for sellers across the board. The market was saturated with items being sold at a discount and buyers were hesitant to make purchases. While this was true for most items, it wasn’t as extensive for Oak.

This occurred for two primary reasons. First, Oak is a supermajority material. The tradelands version of this term means it has to maintain a dominant role in trade volume among Wood products. As of today, GISE is reporting Oak as having 74.04% of the overall market share. However, the second reason is that Oak only owns 2.06% of the Market Capitalization for Wood products. When you put these two factors together, it means means that oak is easy to buy and sell, but buyers and sellers don’t set the price. Instead, the overall trend of the economy does. More specifically, right now only 7.36% of Oak’s overall price can be controlled by players.

One of the interesting things that might occur in June because of this unique position is that Oak may become more valuable than Iron. If this happens, it could mean an unprecedented fall for the M&G Index, as earlier this year Iron was trading at nearly twice the price of Oak. This possibility could see lumberjacks become a Tier 1 profession if it happens.

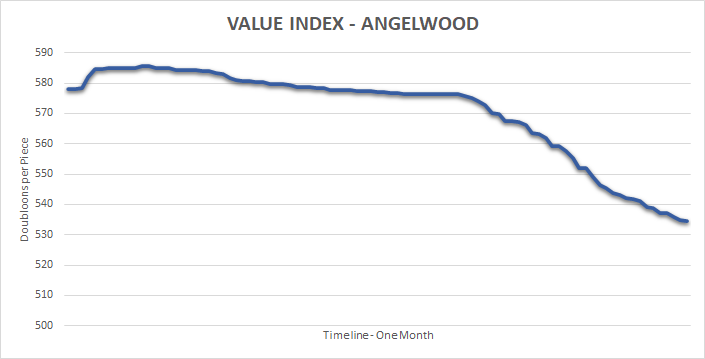

The Angelwood Collapse

Throughout the Purshovian Release, Angelwood looked like it was going to be resilient. But that resiliency fell apart as soon as the event ended. The drop was more severe than other premium woods, but this was most likely due to playing catch up than a more alarming trend.

On the plus side, Angelwood tends to stabilize when there is an increase in demand. The market is currently sitting at around 15% demand, which indicates it will probably stabilize within the next week or two. However, the damage is already done as Angelwood lost six months of value in the month of May.

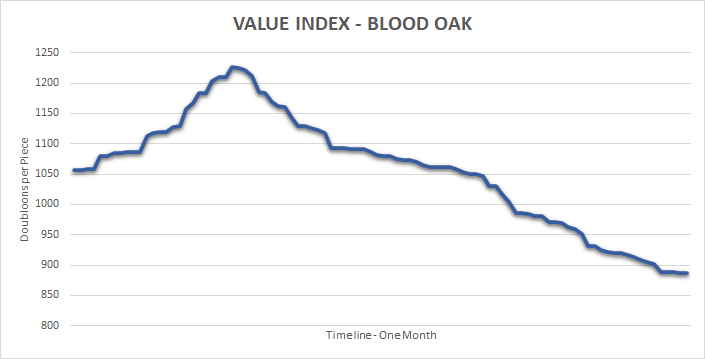

Blood Oak Manipulation

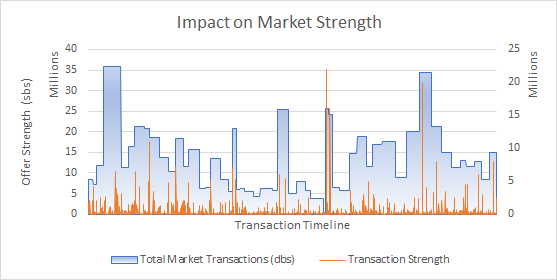

It seems like we report each month on Blood Oak’s instability, and we are going to do it again. The unfortunate story this month is that price manipulators had some early success, but then had it completely erased due to a mid-month price correction that was effective at lowering the price back to it’s April 1st price point.

The price correction used is called a bear raid. Normally, these are done by a coalition of sellers that attempt to drive the prices lower, or level them off at a specific point. Normally this type of raid is successful for a short period of time, but due to the normal volatility of Blood Oak, it was effective at starting a price trend that dropped it to last quarter’s pricing position.

In other words, this market continues to be highly unstable, and we do not recommend investing in this material.

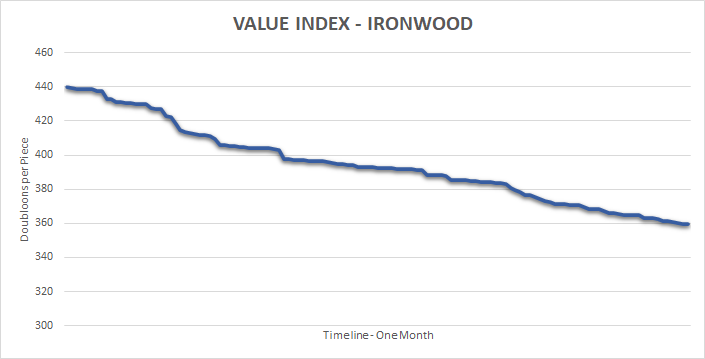

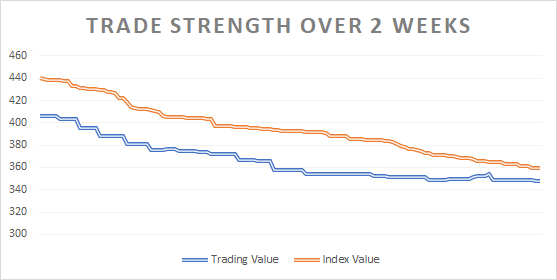

Ironwood

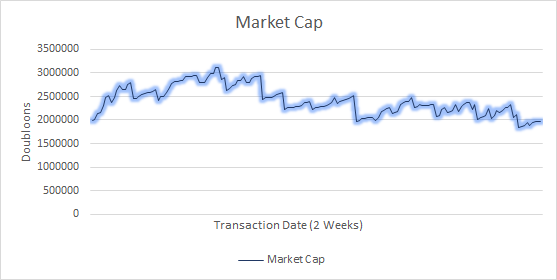

In our previous analysis, we noted how Ironwood was benefiting from the release of the Demeter for its cosmetic likeness to modern steam ships. Let’s look at where it ended up in terms of price and overall demand.

Fortunately, the price of Ironwood doesn’t tell the whole story. There was a definite increase in trade volume for Ironwood in May, meaning that the price drops were more around meeting buyer demand than representing an overall loss. About a week before the Demeter went off sale, the market reached 80% saturation, meaning anyone who was going to sell Ironwood effectively tapped out. However, this was followed by an explosion of re-stocking, at the same time the Demeter went off-sale (and as a result, the demand for it as well) leaving the wood to follow the same trend as the rest of the market.

As of writing this report, Ironwood’s index has reached its trading value. That means we can expect price stabilization in June, possibly even an increase. However, that outcome requires some stability of buyer and seller demand, which was thrown into chaos with the Demeter. We hear that another ship may get released, so it’s possible this chaos will continue, but we think it’s more likely that ironwood will be taking a backseat on the market for a while.

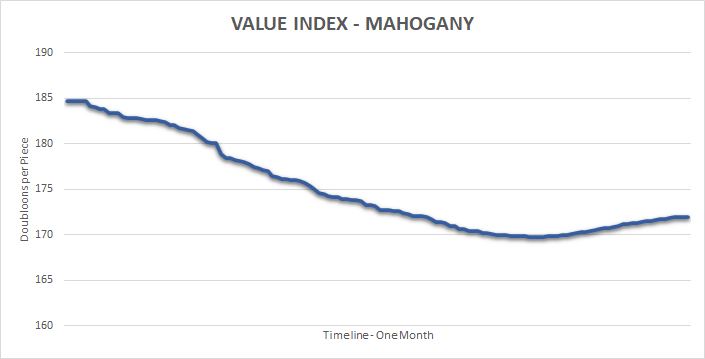

Mahogany Rebounds

One of the first materials to see a rebound once the Demeter went off sale was Mahogany. This material is usually an early indicator of market performance because it is consistently traded below its market value due to its reputation in-game. In other words, it is less influenced by player demand and more by market trends.

The fact that it has already risen by $2.12 Doubloons per piece in one week of trading means there is hope the wood market could completely rebound by the end of June. This is one of the main reasons why we are optimistic about the lumber market going forward.

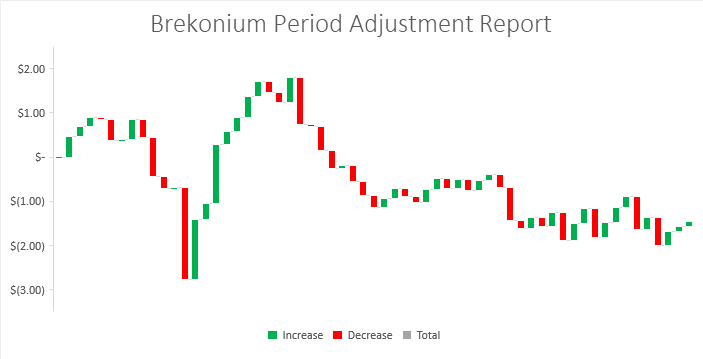

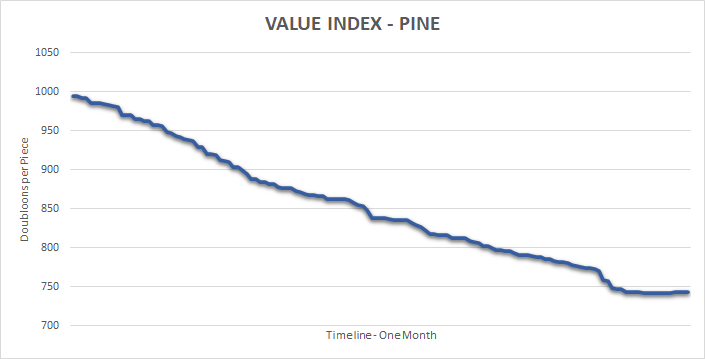

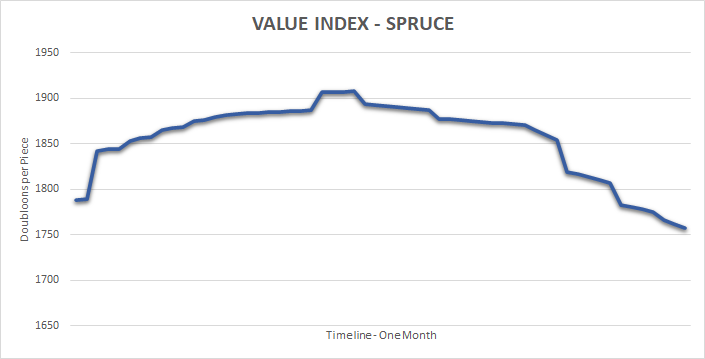

Pine and Spruce Debacle

As anticipated, Pine and Spruce ended lower at the end of May. The results are slightly worse than we expected, likely impacted by the overall downturn, but this is still driven mainly by their removal as a critical resource for ship building.

There is still some hope for Spruce that, due to its somewhat unique cosmetic qualities, it is seeing an increase in demand following the Demeter. Demand is pushing for it to fall a bit lower, however, so it remains to be seen if sellers will buckle to this new price point or continue to try and keep it inflated at $1.7k per piece. The market cap is falling, so if sellers wait too long there might not be a market left to support the higher price point. The other hope for Spruce is to have the developers add some items that continue to use its exclusivity.

Unfortunately, Pine is probably done for. A -33.83% price reduction, low demand, and similarities to the much cheaper Elm means this wood has a long road to recovery. The one positive we see in all this is a consistent push to keep prices just above the cost of premium woods like Angelwood and Blood Oak. That will lead to some volatility over the next few months until the market can decide its true value.

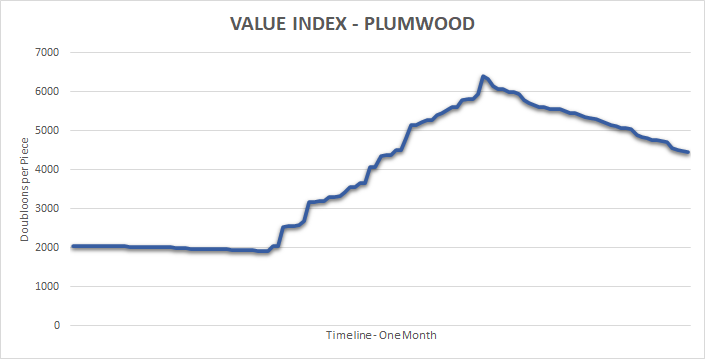

Ignore Plumwood Prices

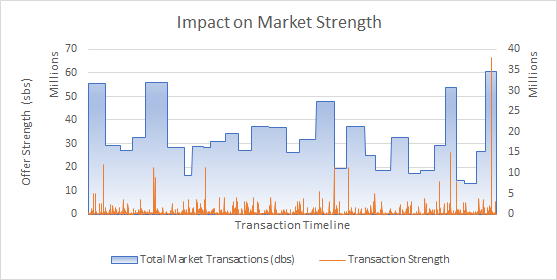

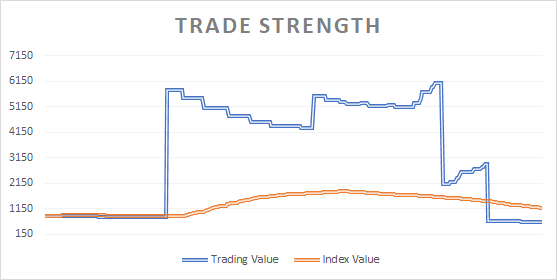

One cautionary note we have to put into this update is the price of Plumwood. On the surface, this looks like an amazing option. It was the only wood to see a significant price increase during a down month, it was priced at over $6k per piece during the Purshovian Update, and it has some nice up/down momentum.

However, these are signs of instability. Keep in mind that Plumwood was just released, so the long-term price point for the wood hasn’t been set yet. The rise and fall of Plumwood was due to a method of price manipulation called a Bull Raid. This is when a trader attempts to push prices up through selective price manipulation.

The results of this attempt had some initial success, as demonstrated by the two solid upward ticks early on, but were then slowed down by other traders entering the market. Finally, the attempt hit a peak, followed by the inevitable fall at the end. This shows that the effort has largely failed. The main reason for the failure is that the group attempting to manipulate the prices misjudged the market cap for Plumwood. In turn, they did not purchase enough material to maintain a long-term price change and offset counter momentum from other sellers. Moreover, they chose to do this on a market with low demand which caused all interest in the wood to evaporate once the price point his $6k per piece. This is why you see the instant and steady fall in price once this happened.

Still, we believe the group performing this market correction was able to make around $550k in revenue before the effort failed. For what it’s worth, if you consider the cost of goods, which is $3RS per wood, the group netted a profit of $4,3714 Doubloons per piece sold. Not a bad haul, all things considered.

This is a cross-post from the Tradelands News Network.